The core mandate of most Central Banks is clear: ENSURE PRICE STABILITY (A select few, like the Fed, also target maximum employment).

But their recent behaviour does raise this fundamental question: are they still solving the price stability problem? or have they conceded that fight?

This is fundamental because Central banks, the very institutions tasked with fighting inflation, are in a historic panic-driven gold rush.

Here is the data:

2022: 1,082 tonnes. That was the highest level since records began in 1950 and double the 2021 figure.

2023: 1,037 tonnes

2024: 1,045 tonnes. Marks the third consecutive year of a 1000+ purchase.

2025 (Projection): 600-700 tonnes, as de-dollarization and reserve diversification become entrenched policies.

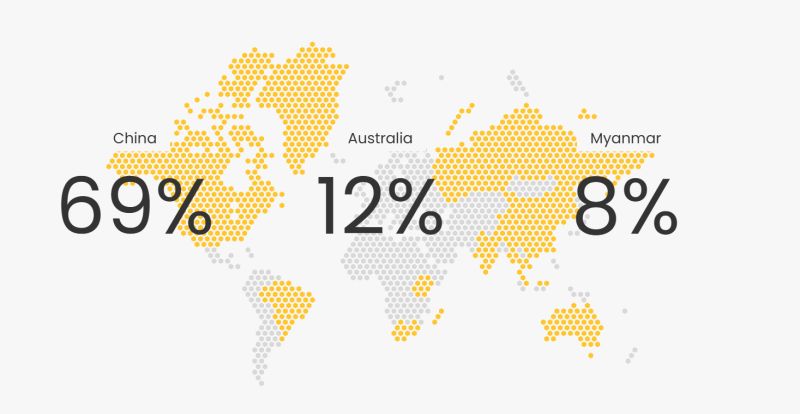

The numbers show this is not a vague trend; it is driven by clear, repeat (but somewhat patchy) buying by Central Banks worldwide.

Why do I say, ‘somewhat patchy’?

Well, look at some of these buying patterns:

The PBOC paused its 18-month gold-buying streak in mid-2024, only to resume months later.

After a record 2022 purchase, Turkey briefly turned seller before launching a new, ongoing 27-month buying streak.

And then, there are some non-traditional buyers showing clear intent in 2025.

Which Central Bank has made the highest net purchase of Gold this year?

Russia?

No.

China?

No.

Surely Indonesia then?

No.

It’s Poland.

Next largest buyer?

China?

No.

It’s Kazakhstan.

The frenzied nature of the buying from the very fountainheads of monetary policy is unusual.

Central Banks are expected to combat inflation using interest rates and liquidity operations. Not by hoarding a ‘store of value’ themselves.

So, why the frenzied buying?

If it is to hedge themselves against the very inflation they are mandated to control, then it’s ironic!

Geopolitical concerns and the threat of confiscation of reserves are valid, but is that enough to justify this scale of buying?

1000+ tonnes? Year-after-Year?

This leads to two critical points:

1. What happens when Central Banks realize that their massive gold stockpiles generate zero cash flow? There is a massive opportunity cost there!

2. And if these are the leading moves to build a war chest to pay down ballooning public debt, then history offers a stark warning.

Look no further than the Central Bank Gold Agreement (CBGA) of the late 1990s. Coordinated selling to manage the price led to a 10+ year bear market.

Now, imagine the reverse: A coordinated gold sell-off (again!) by indebted nations could trigger an unprecedented price spiral.

Central Banks’ gold stockpiling ultimately reveals a lack of confidence in the fiat system they oversee.

In other words, Central Banks are preparing for a scenario that their own policies may have helped create.

Traditional Central Banking as we knew it appears well past its shelf life.

And that may not really be a bad thing.